Exploring the diversification of DC charger suppliers

This edition will focus on DC charging suppliers in the EV industry! At Gireve, we are at the heart of the EV charging industry, empowering CPOs and eMSPs with our seamless roaming platform. Combining marketplace technologies, transaction processing, and data management, our mission is to support stakeholders and accelerate their transition to electric mobility on a global scale.

But we don’t stop there; in fact, we process and enrich data on charging stations and driver behaviors. We offer insightful analysis and strategic consulting. We believe that this wealth of information will shape the future of mobility, making it sustainable, innovative, and accessible to all.

This is why we’re sharing a series of insights learned from our data, to foster discussions and learn together.

We are happy to present our monthly publication related to our Data and Consulting department: Beyond EV Charging

Executive Summary

This paper analyses the development and distribution of fast charging suppliers in the EV charging industry. As infrastructure operators, CPOs must carefully select suppliers for their fast-charging networks. While the current market trend leans towards depending on a single major supplier, recent developments, exemplified by IONITY incorporating two new suppliers in 2023, Alpitronic and Ekoenergetyka , suggest a potential evolution in this approach. Still, the insights shown in this paper indicate a trust in the reliability of infrastructures provided by these suppliers, with a majority of European-based stakeholders (constituting 2/3 of the market).

Currently, operators engage with an average of 4 suppliers, with around half relying on just one or two, while some even depend on as many as 12 different suppliers. Larger CPOs demonstrate a preference for distributed charging systems compared to smaller networks, as this strategy can effectively reduce the costs associated with extensive charging hubs.

How do CPOs handle EV charger diversification?

In this third paper, . You will access an analysis of several CPOs operating networks over 50 kW, ranging from medium to large in Western Europe (France, Belgium, Netherlands and Luxembourg).

Analysing public fast charging networks

Given the recent emergence of this ecosystem, CPOs have made different supplier choices for their infrastructure. With the rapid development of fast chargers in the past two years, our aim was to scrutinize the decisions made by CPOs concerning their network infrastructure.

Currently, the market offers a multitude of EV fast and ultra-fast charger suppliers. Our focus was to examine the decisions made by CPOs to discern whether they diversify their suppliers or prefer a singular major supplier.

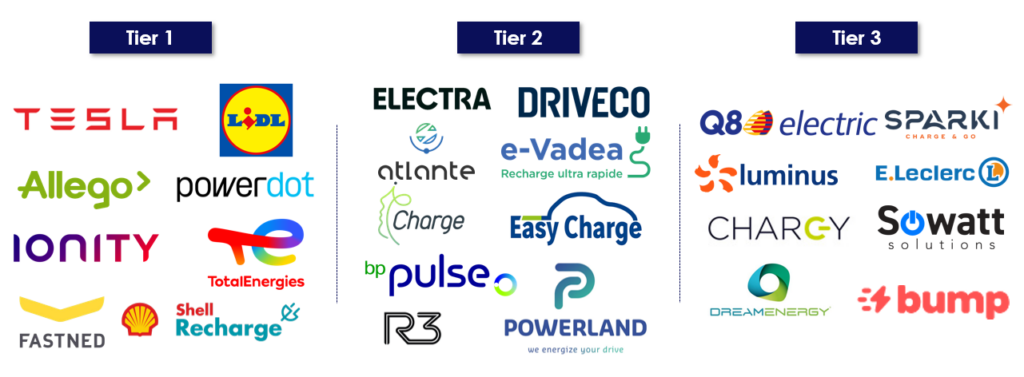

To achieve this, we conducted an analysis of public fast charging networks across various CPOs of different sizes, categorizing them into three tiers based on their number of charge points (in the selected markets):

- Tier 1: Over 1,000 charge points

- Tier 2: Over 100 charge points

- Tier 3: Less than 100 charge points

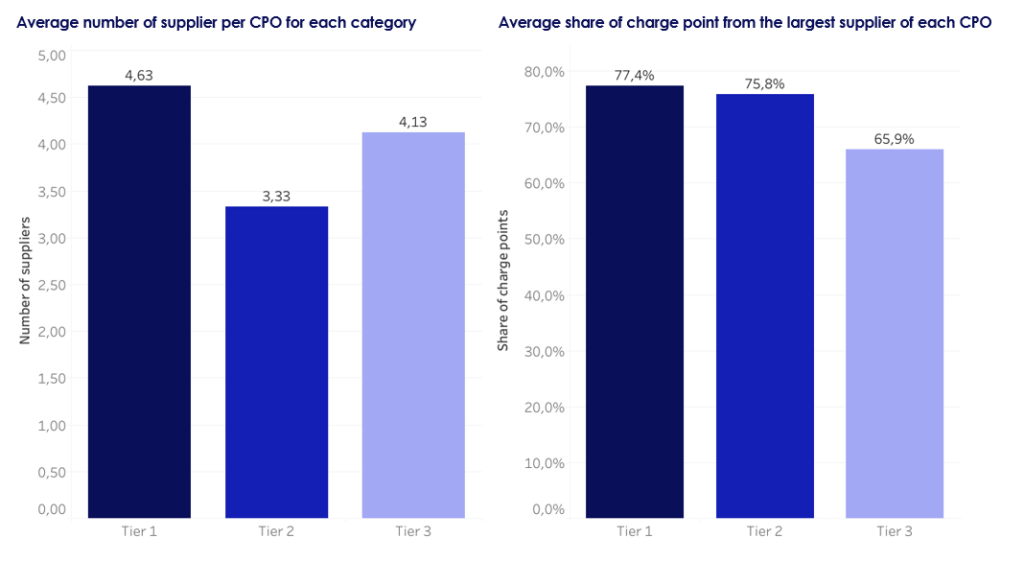

How many suppliers do CPOs have and how are they allocated?

In average, CPOs have 4.0 suppliers for their EV chargers and their largest supplier represents 73% of their charge points. This tells us that CPOs trust their largest supplier to provide them with great and reliable EV chargers. In addition, 50% of CPOs have 1 or 2 suppliers, showing a trend in relying in a small number of actors. This is also explained by the fact that most CPOs install fast and ultra-fast chargers on their charging hubs and use 1 provider for each power category. Also, some can test other charger manufacturers on a few charging hubs to compare them.

Additionally, CPOs can limit the number of suppliers to simplify their operations. Each supplier has its own way of developing the hardware and software of their charging station, therefore communication with the charging station management system (CSMS) of the CPO has to be adapted for every supplier. Fewer suppliers means less operating and maintenance costs as the CSMS is suited for those chargers.

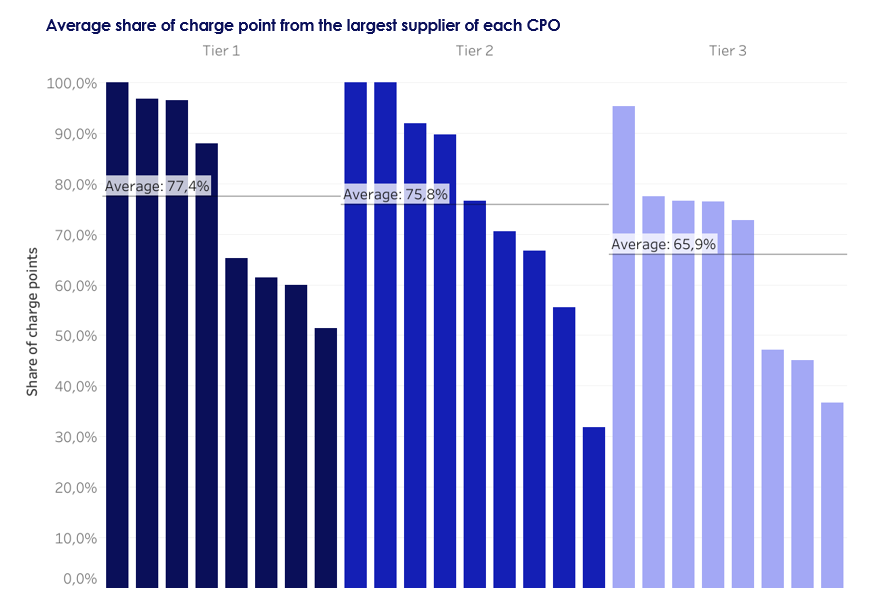

Regarding the different categories, largest CPOs tend to rely on one major supplier for more than 3 quarters of their network while smaller networks are slightly more diversified. The number of suppliers seems to not be related to the size of the network.

If we look in detail the share of the main supplier of each CPO (figure below), we can see that only 4 have their main supplier representing less than 50%, This shows that most rely on one major partner and trust them for their network.

Furthermore, 6 CPOs have their main supplier accounting for over 95% of their network, showcasing not just complete trust but also a substantial reliance on this particular supplier.

Details on suppliers

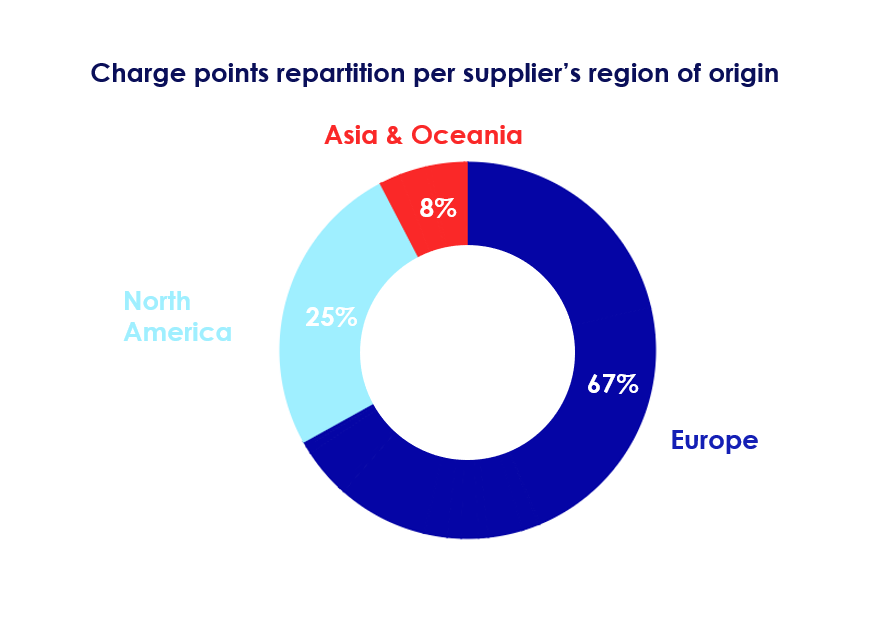

If we look now into the origin of fast charging networks’ suppliers, it reveals that European actors dominate this segment with 2 third of the market share. Actors such as ABB, Kempower and Alpitronic play a significant role in this segment as they are chosen by the most prominent CPOs. North America’s share is primarily associated with Tesla as it is the largest CPO network in Western Europe.

Structure of the charging hubs

CPO make different choices in structuring their charging hubs. They can either use standalone EV chargers, where the conversion from AC to DC occurs inside each charger, or opt for a distributed system, where a power unit handles the AC to DC conversion, and user units (or satellites) solely provide the user interface along with the cable and plug.

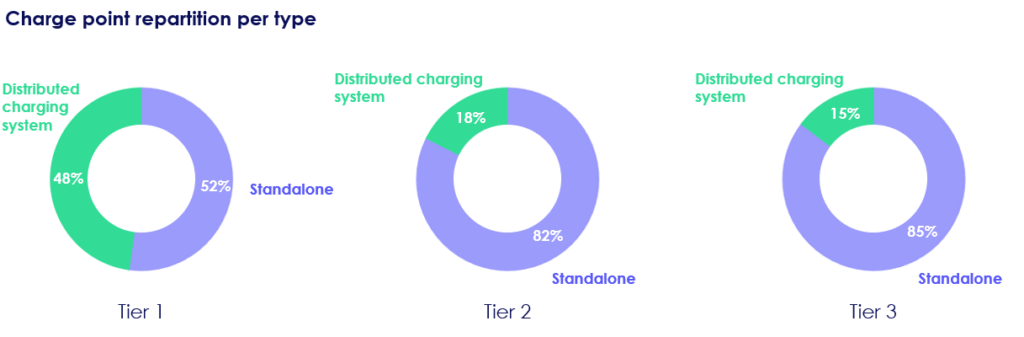

In Western Europe, while 43% operate distributed systems. The graph below reveals that the majority of Tier 2 and 3 CPOs prefer standalone chargers, whereas the distribution is more balanced for Tier 1 CPOs. Tier 1 exhibits greater equilibrium due to the significant influence of Tesla in the distributed charging system segment. Distributed charging systems allow for a reduction in capital costs by decreasing the number of power converters. With distributed systems, CPOs manage a higher number of charge points per charging hub on average, this is why they can be more suitable for the largest CPOs.

Additionally, 6 out of the 9 Tier 1 CPOs employ both configurations in their network, whereas the majority of Tier 2 and 3 CPOs opt for a singular configuration.

Conclusion

Most Charging Point Operators tend to select a primary supplier for their fast-charging network, often favoring European manufacturers. On average, the principal supplier accounts for three-quarters of a CPO’s network, indicative of a high level of reliance on these suppliers’ services. Moreover, larger CPOs more often opt for distributed charging systems, simplifying extensive charging hubs and potentially reducing costs, while smaller networks predominantly utilize standalone chargers.

The fast-charging industry remains relatively new, comprising a diverse range of players. Observing industry trends will be crucial to discern whether there will be a shift towards a more diversified supply chain or if the current pattern will persist. For instance, IONITY recently unveiled two additional suppliers, EKO Energetyka and Alpitronic, for their European fast charging network, thereby sourcing chargers from four different entities (including the existing suppliers ABB and Tritium). Conversely, newer entrants like Electra, Sparki, or NW IE Charge have opted for a single major supplier to furnish their entire network.