What's the average available power output of standalone ultra fast chargers in France?

Discover the available power output of standalone ultra fast chargers in France! At Gireve, we are at the heart of the EV charging industry, empowering CPOs and eMSPs with our seamless roaming platform. Combining marketplace technologies, transaction processing, and data management, our mission is to support stakeholders and accelerate their transition to electric mobility on a global scale.

But we don’t stop there; we process and enrich data concerning charging stations and driver behaviours. We offer insightful analysis and strategic counsel. We believe that this wealth of information will shape the future of mobility, making it sustainable, innovative, and accessible to all.

This is why we’re sharing a series of insights learned from our data, to foster discussions and learn together.

We are happy to present our monthly publication related to our Data and Consulting department: Beyond EV Charging.

Executive Summary

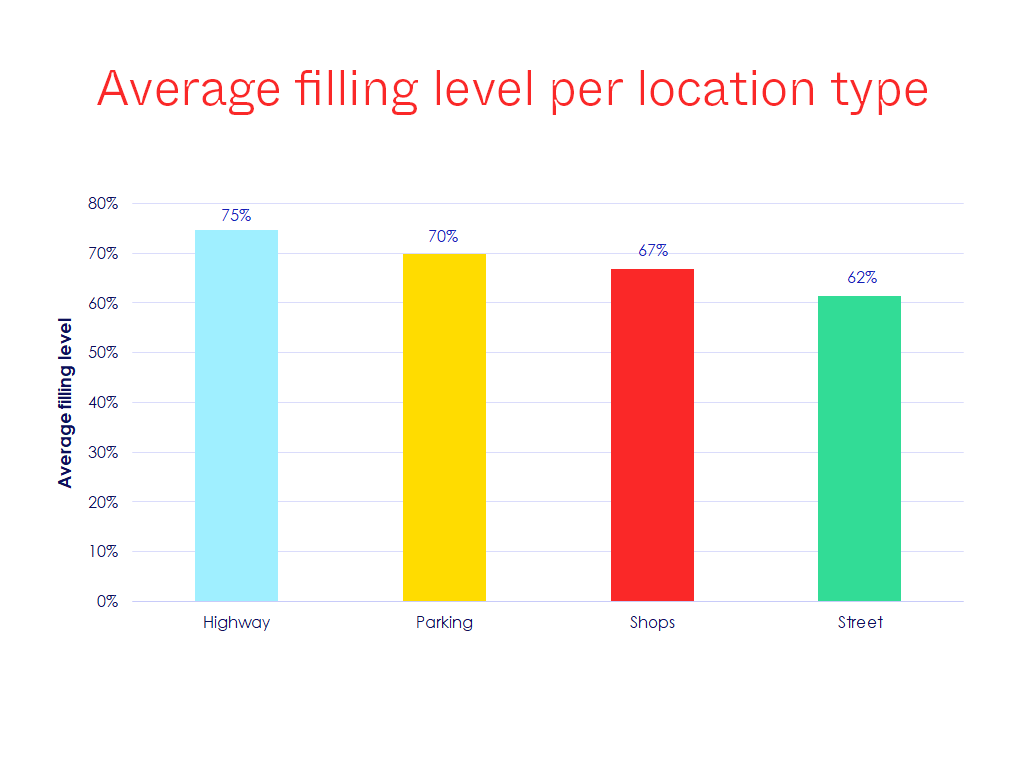

This paper examines the available power output of standalone ultra-fast EV chargers in France, taking into account 8 models from 8 different brands. Standalone chargers house the AC/DC conversion within each charger unit. While some chargers can theoretically deliver 300 kW, most EVs cannot utilize such power. This is why CPOs do not equip their standalone chargers with the highest number of power modules, thereby reducing upfront costs. Consequently, chargers have variations in their theoretical power output and their available power output based on choices made by the CPOs who install them. We refer to the ratio between these two as the “filling level.” Chargers display a significant variance in their average filling levels, ranging from 55% to 90%, depending on the brands. Charger location also appears to have an impact, with highway chargers boasting the highest filling levels, while supermarket and on-street chargers start with lower power levels.

What's the average available power output of standalone ultra fast chargers in France?

In this first paper, discover how EV charger’s brand and model plays a role in available power output and how charge point operators are gearing up for the future, from 100 kW to a staggering 300 kW and beyond.

Don’t miss our in-depth analysis of standalone chargers in the French ultra-fast charging network. Find out what’s available for EV drivers based on brand!

Standalone chargers vs Distributed charging systems: what's the difference?

Each charge point operator (CPO) has a choice in structuring its charging areas. They can either use standalone EV chargers, where the conversion from AC to DC occurs inside each charger, or opt for a distributed system, where a power unit handles the AC to DC conversion, and user units (or satellites) solely provide the user interface along with the cable and plug.

Standalone EV chargers have a larger footprint and are bigger due to the presence of the AC/DC converter. Their power output depends on the total number of power modules installed within each charger. Prime examples of charge point operators using this structure include Fastned, Electra and Allego.

In contrast, a distributed charging system benefits from smaller user units, as there are fewer components to integrate, and the power units are situated at the areas, mostly on the side. The two best examples of charging areas utilizing this approach are Tesla and Power Dot. Additionally, since the AC/DC conversion takes place on the side, each satellite can maximize its power output, depending on the operator’s sizing.

Standalone - Looking at the French network

Looking into our data, we decided to focus this first paper on the average available power output of standalone chargers across the French ultra-fast charging network. We included data from eight different brands. This provides a comprehensive overview of what is currently available for EV drivers, depending on the charger’s brand.

As you can see on the figure above, there’s a significant difference between the maximum power output of charging stations like the Hypercharger (Alpitronic) HYC300 and the SIEMENS Sicharge D, both capable of 300 kW, and the actual available power delivered to EVs. In reality, the majority of EVs cannot charge at speeds exceeding 150 kW with DC charging, with an average maximal power input of about 100 kW in France, according to AVERE (Expert barometer). This is part of why CPOs don’t fill up their standalone chargers with the maximum number of power modules.

The EVBox Troniq Modular, even though it has a maximum output of 240 kW, is typically only filled to about 55% of its capacity, resulting in an average output of 132 kW. Therefore, the Troniq Modular is the ultra fast standalone charger with the lowest filling level from this sample.

Finally, the DBT CEV ULTRA and Circontrol Raption 100 have maximum outputs of 150 kW and 100 kW, respectively. However, their average filling levels are only around 65%. This suggests that charge point operators (CPOs) may not have seen the need to deploy the maximum power output for these stations, likely due to the limited demand for such high charging speeds at their locations.

Standalone - Power output and location

For CPOs opting for standalone EV chargers, the location will be a primary consideration in the choice of power output. As shown in the graph below (displaying data from our ultra-fast charger sample), depending on whether the charging area is located in a supermarket parking lot or along a highway, operators may adopt different strategies. For instance, they tend to maximize the power output along highways since there is a higher likelihood of vehicles seeking to charge at their full capacity. In contrast, ultra-fast charging in a supermarket’s parking lot may not currently require the full potential of these chargers.

CPOs may adopt different strategies based on the charging locations and user needs. They might begin with a minimal power output, as most electric vehicles today can handle around 100 kW. However, they can add power modules in the future to achieve outputs of 200 kW or higher.