Wholesale price Index for public EV charging

To bring more transparency to the wholesale charging market, we created a price index and analysed its evolution throughout 2023.

At Gireve, we are at the heart of the EV charging industry, empowering CPOs and eMSPs with our seamless roaming platform. Combining marketplace technologies, transaction processing, and data management, our mission is to support stakeholders and accelerate their transition to electric mobility on a global scale.

But we don’t stop there; we process and enrich data on charging stations and driver behaviors. We offer insightful analysis and strategic consulting. We believe that this wealth of information will shape the future of mobility, making it sustainable, innovative, and accessible to all.

This is why we’re sharing a series of insights learned from our data, to foster discussions and learn together.

We are happy to present our monthly publication related to our Data and Consulting department: Beyond EV Charging

Executive Summary

The electric vehicle (EV) charging industry is evolving rapidly with key stakeholders including EV drivers, Charge Point Operators (CPOs), and e-Mobility Service Providers (eMSPs). As the industry grows, numerous entities have entered the market. This led to the establishment of roaming hubs like Gireve to facilitate interconnection. The wholesale charging market, characterized by its fragmentation, lacks transparency. Initiatives such as Gireve’s price index is done to improve competitive conditions. Analysis of the wholesale market price index revealed that DC prices at shops and supermarkets have increased while highway DC prices decreased significantly in 2023. This highlights the importance of monitoring trends, fostering competition and improving transparency in the industry’s evolution informed decision-making and better end-user experience.

Introduction: Main stakeholders in the EV charging industry

EV charging is an emerging industry with various stakeholders. The public charging ecosystem has developed around three primary players:

- The EV driver, who utilizes their electric vehicle (EV) and can charge it at a charging station.

- The Charge Point Operator (CPO), responsible for operating charging stations.

- The e-Mobility Service Provider (eMSP), offering services to access multiple charging stations regardless of the operator.

This industry has evolved differently from traditional gasoline refueling due to the ability to charge at various locations, including one’s home. Consequently, it has led to diverse use cases distinct from those of refueling gas.

Given the newness of the ecosystem and its lower barriers to entry, numerous entities have launched businesses or services to provide charging to EV drivers (cf. paper 5 on CPO segmentation). This multitude of actors has necessitated interconnection, leading to the establishment of roaming hubs such as Gireve.

As eMSPs facilitate access to charging stations, they must establish connections with CPOs. They can do it either through roaming hubs or directly. This connection involves technical integration. It also implies negotiating roaming agreements, including B2B pricing. This is described as the wholesale market, where CPOs sell charging services in large quantities to eMSPs negotiating pricing and conditions. The retail market is where eMSPs sell their service to EV drivers. CPOs may also participate in this market through credit card or proprietary apps.

Wholesale Price Index 2023 for public charging in France

The wholesale charging market is fragmented, with several hundred CPO and eMSP players, and transaction volumes are growing exponentially This market is fairly opaque because information on prices and the quality of services exchanged is not readily available or accessible to stakeholders. With the aim of improving competitive conditions on the wholesale market, Gireve has created a price index family (€/MWh) to monitor B2B price trends on its marketplace.

In this paper, we will examine this wholesale market price index to detect trends.

Overall market

The average wholesale price index for France in 2023 was 482 €/MWh. This is higher compared to 2022 with a difference of about 3% between the two.

During 2023, it has decreased continuously with an annual decrease of about 3% (going from 499 €/MWh in January to 485 €/MWh in December).

Those variations remain stable considering the environment for electricity prices in 2022 and 2023 with the energy crisis.

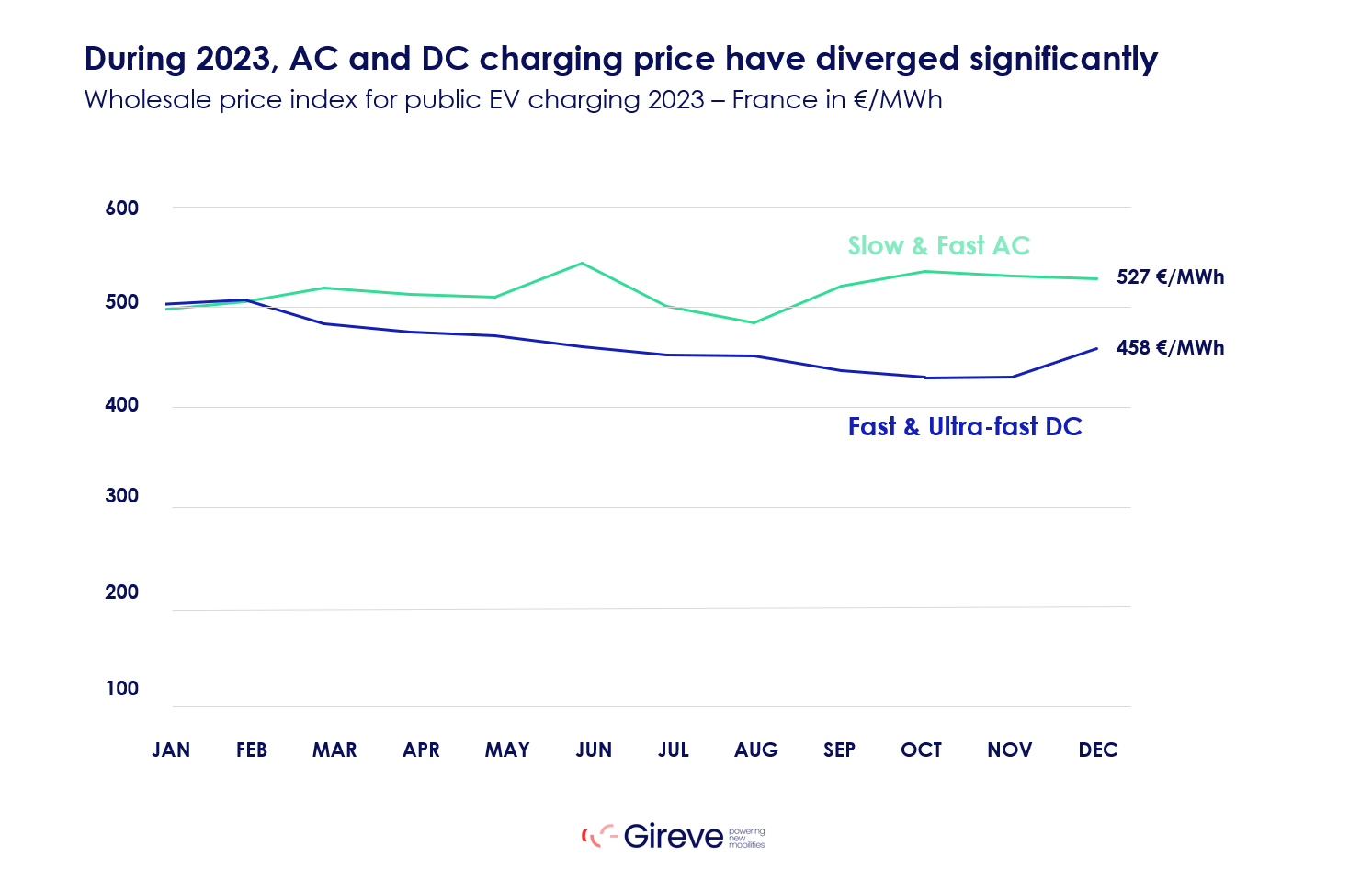

Price Index for AC vs DC

The price index provides a general overview of the wholesale market. We propose distinguishing between two segments: AC (<= 22kW) and DC (>22 kW). Indeed, these segments differ significantly; AC offers slow charging for use cases like on-street charging, while DC provides rapid charging for longer journeys or destination charging.

As illustrated in the graph below, a noticeable divergence in the price index between AC and DC occurred at the beginning of the year. Interestingly, despite delivering less power, AC has a higher price index for the year (515 €/MWh) compared to DC (455 €/MWh). This can be partly attributed to the fact that AC charging necessitates longer parking periods. It makes it more susceptible to duration-based tariffs, particularly in urban areas.

Digging deeper, within the AC category, the price index is polarized. Slow AC (<= 7.4 kW) commands a higher price index (approximately 710 €/MWh in 2023) compared to fast AC (7.4 kW < P <= 22 kW), which aligns more closely with DC charging. Conversely, the DC charging categories exhibit more concentration.

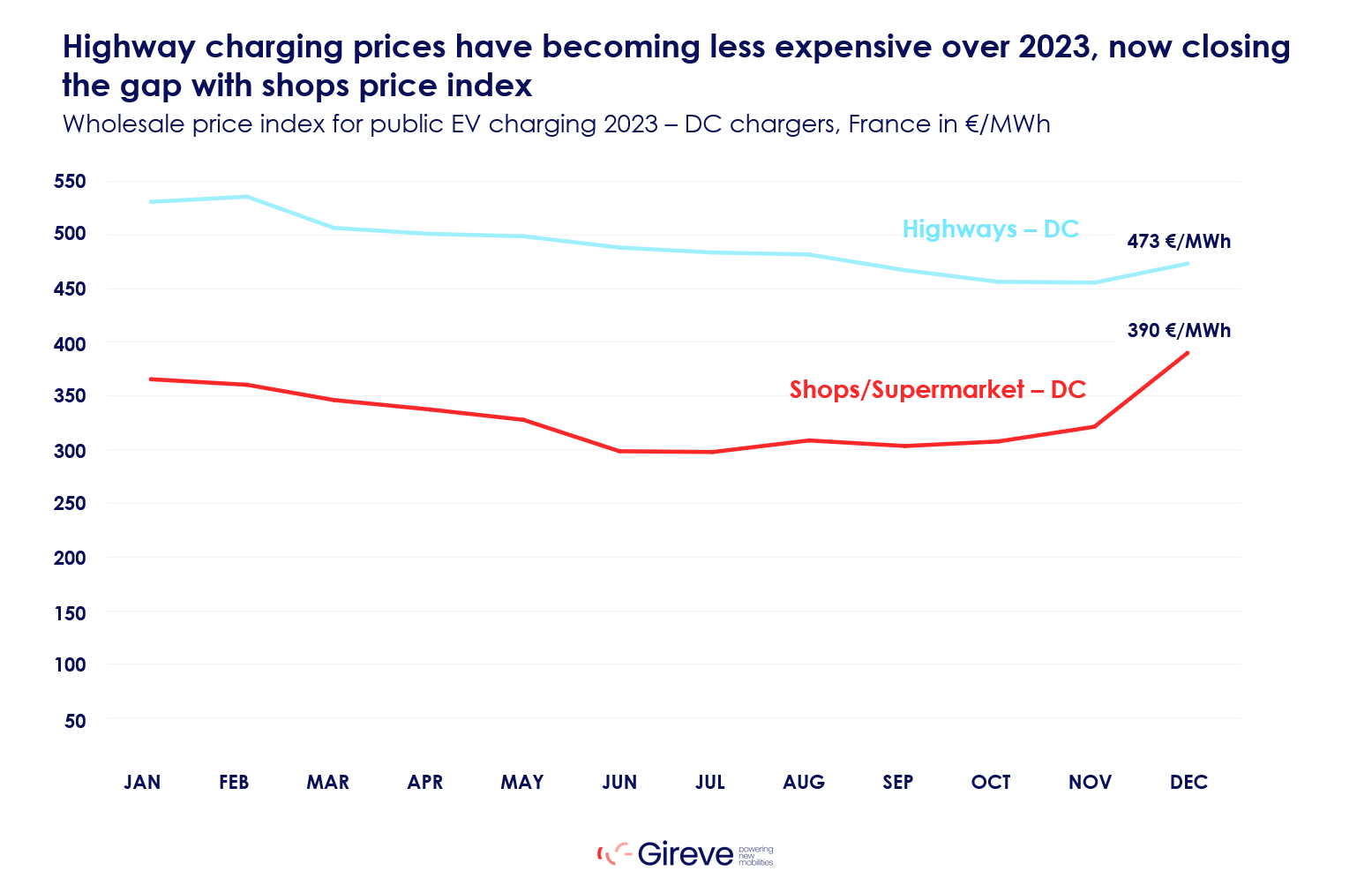

Focus: DC Price Index for Highways and shops

DC charging is considered essential for enhancing electric mobility, particularly for long-distance travel, which is a primary concern for EV drivers. Our 4th paper demonstrates the accelerating adoption of DC charging in France, even in retail settings such as shops and supermarkets, where retailers recognize an opportunity. Unlike highways, retailers face different constraints, making a comparison between the two settings intriguing.

According to the graph below, the price disparity between highway and shop charging was significant at the beginning of 2023. Shops were 45% cheaper than highways. This discrepancy can be likened to gas stations, where highway stations offer convenient services. Moreover they don’t have the same constraints as supermarket charging stations, such as grid capacity and accessibility. However, in 2023, there was a significant decrease in highway charging prices, decreasing annually by 12%, while shop charging prices increased. Consequently, the price gap between the two has narrowed to approximately 21%.

Conclusion

To conclude, the wholesale price index for public charging in France has not varied surprisingly much in 2023 compared to 2022, despite the energy crisis. Although AC charging delivers less power to EV drivers, its price index is higher than that for DC, as duration-based tariffs can be applied, especially in urban areas. A continuous decrease in highway charging was observed in 2023, while shop charging has increased.

The market logic is establishing as the industry grows, and everyone is adapting their strategies depending on the evolving trends of the market. Our price index aims at highlighting the evolution and helping actors to adapt accordingly.

Charging will slowly become more competitive. Competition at the same location is beginning, for example, in Germany and the Netherlands, where several CPOs have charging stations at the same service area or parking lot. Each actor will have to balance between maximizing revenues on one side and increasing customer preference via attractive prices for eMSPs or apps on the other side.

More on our wholesale market price index for public charging

From our estimation, this European wholesale market in 2025 and €6 billion in 2030.

This price index has been created to:

- Improve market conditions by providing a price benchmark

- monitor market trends through a macro and aggregated view of prices

- Develop new commercial mechanisms (hedging instruments, indexed roaming contracts, etc.).

- make informed decisions about future investments.

Gireve’s central position as a marketplace operator makes it a knowledgeable player, helping to improve conditions of competition and transparency.