A comprehensive analysis of fast charging in Europe

This edition will be a bit different, as we’re taking the opportunity of Beyond EV Charging #7 to introduce you to our fast charging analysis, presented by our team in late April 2024 during the EVS 37 in Korea.

Our Consulting Department, together with our Data team, delved into deep analysis of fast charging evolution in Europe, looking at the influencing factors depending on the country.

We will give you an overview of the content in the current article, but we invite you to download the full paper for more content and graphs.

Download our Fast Charging paper!

Executive Summary

In the European landscape of battery electric vehicle (BEV) adoption, the expansion of fast charging infrastructures plays a pivotal role. This paper delves into the journey of fast charging networks across the continent. It highlights the intricate interplay of economic incentives, technological breakthroughs, regulatory frameworks, and market forces that have propelled their growth. It points out disparities among European countries in BEV market penetration and infrastructure readiness. The discussion extends to the strategic deployment of fast charging infrastructures. These are located along major highways and in large retailer parking lots, influenced by political initiatives and the retail sector’s commitment. Collaborative efforts between automakers also play a part. Looking into the future, the paper anticipates challenges and opportunities. It notably emphasizes the need for sustained investment and the standardization of connectors and measurement devices. These measures are crucial to facilitate the expansion of the fast charging ecosystem. This exploration offers insights for global markets on similar electrification journeys.

Introduction: Fast charging in Europe

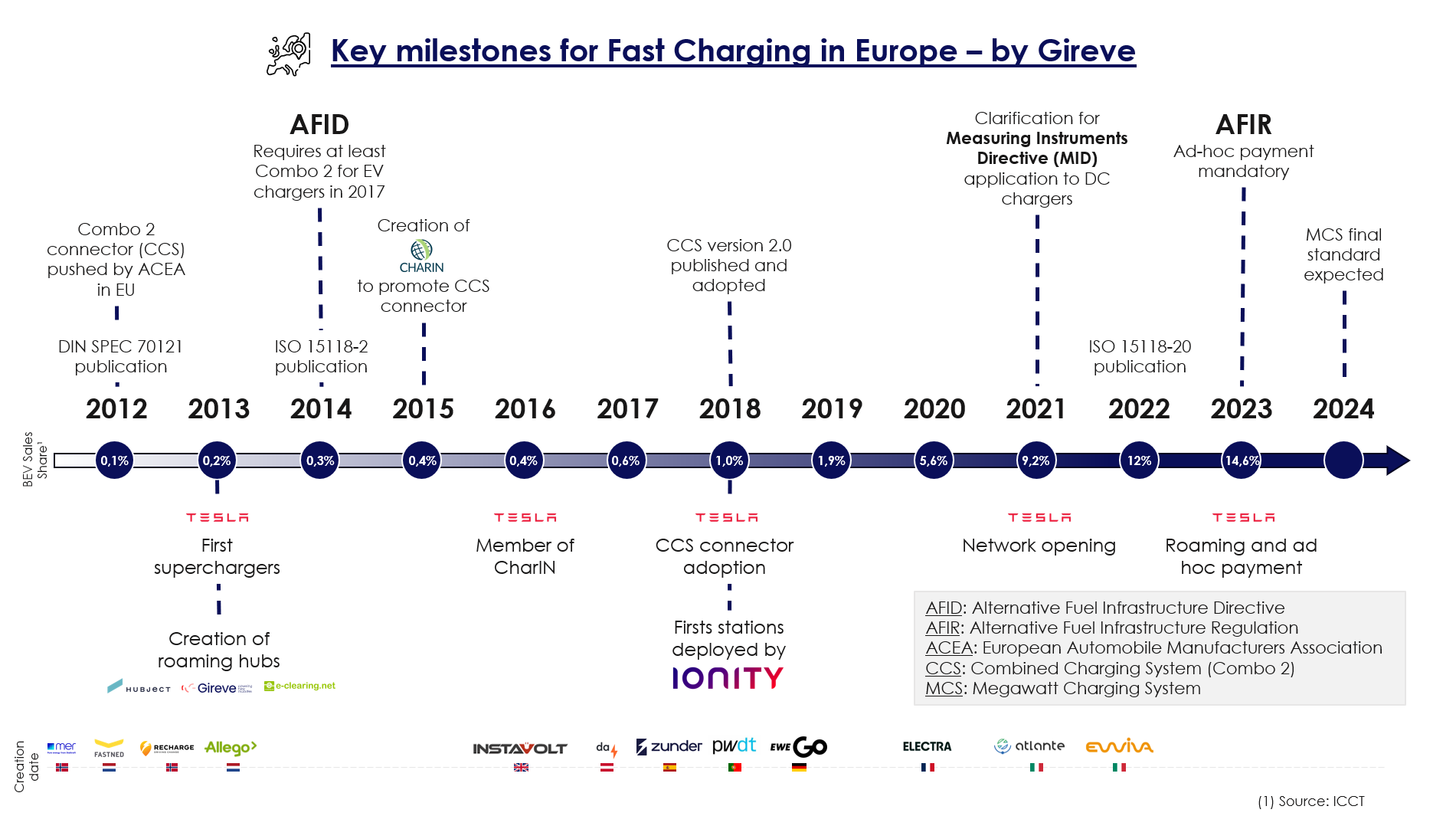

“You’ll be able to travel almost anywhere in the world with an electric car with the same level of convenience as a gasoline car.” – Elon Musk. This was Tesla’s promise during the Superchargers unveiling presentation back in 2012, when Tesla had only six superchargers worldwide. This is where it all began.

Europe, encompassing 50 countries with varied geographies, economies, and political strategies, consistently leads in the BEV adoption. The whole continent promotes initiatives and tackles challenges to promote standardization and foster collaboration.

It is key to analyse the current and past developments of fast charging in Europe. Indeed, it offers key insights for those new to the ecosystem and serves as an important reference for other markets. Fast charging is essential for the progress of electric mobility, making EVs a viable option for long-distance journeys. The past decade has seen substantial progress in this area within Europe, in step with the wider electric mobility sector.

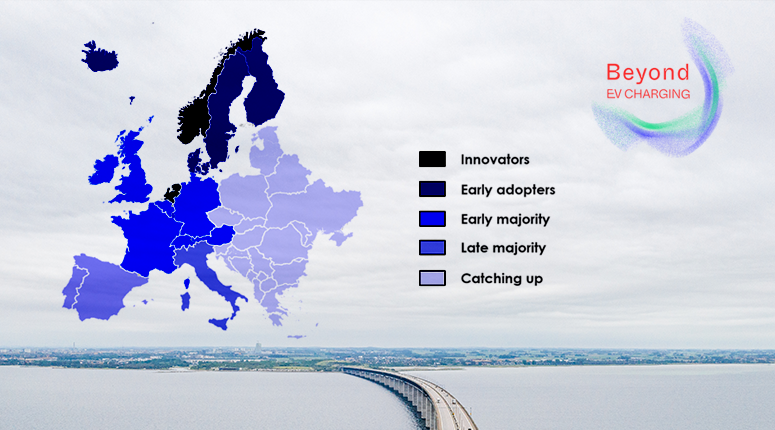

Market readiness

The European market for BEV and charging infrastructure exhibits considerable diversity, reflecting varying degrees of electric mobility adoption and development.

Highways: a natural development for fast charging infrastructure

While the fast-charging market in Europe has experienced swift overall growth, installations on highways have seen an even more pronounced increase. For instance, they have nearly doubled annually over the past two years.

By the end of 2020, early pure players such as Ionity, Fastned, and Allego accounted for half of the highway charging points. Subsequently, Oil & Gas companies recognized the trend and began installing fast charging points, now operating about 20% of highway fast charging points. (see BEVC #5)

Key milestones for fast charging in Europe

Conclusion

In conclusion, this paper underscores the influence of economic prosperity on electric mobility enhancement. Initially, BEV adoption is spearheaded by high-income individuals, leading to a more rapid uptake in countries with higher GDP per capita, though this trend may shift as BEV acquisition costs decrease.

Highway and Fast charging deployment

Fast charging infrastructure is intricately linked to highways. That is to say, analysis reveals a direct correlation between the number of fast charging stations and highway network length. Countries with extensive networks host most fast- charging stations. A key indicator to monitor is the number of fast charging points per highway kilometer, where countries with a high BEV share exhibit favorable equipment rates.

The importance of standardization & policies

The paper illustrates how policies, subsidies, and standardization are vital in expediting fast charging infrastructure development. Latecomers can benefit from the now well-established landscape, avoiding mistakes made by early adopters. They also gain from technological advancements and the experience of actors deploying for over a decade, reducing the cost of fast charging.

Collaboration is key

Collaborative efforts play also a substantial role in shaping the fast charging segment. For example, Ionity serves as a prime example with its early deployment and extensive coverage. Consequently, Central and Eastern countries can benefit from actors like Ionity or Tesla, expanding their networks across Europe. In addition, as the EV ecosystem evolves, retail emerges as a second-phase consideration in fast charging development, suggesting a dynamic progression in infrastructure planning.

Looking ahead: Plug & Charge, MCS standard

Following our insights and conclusions, it is crucial to look towards the future.

This includes considering the potential transformation brought by technological advancements such as the integration of Plug&Charge. This innovation promises a seamless future where BEVs and charging stations communicate effortlessly, ensuring a more intuitive and safer charging process.

What is more, the introduction of MegaWatt Charging Systems (MCS) for heavy-duty vehicles marks a significant leap in available power, aiming to cater to the needs of heavy mobility—a key priority in Europe’s transport decarbonization agenda for the coming decade. Strategic targeting of major European transport routes and learning from past developments can swiftly enable transport companies to cover longer routes more efficiently.

Collaboration in the US

These global learnings from the past, with current and future dynamics are not limited to Europe and can also be implemented in other regions to support the development of the electromobility ecosystem. For instance, in the US, the recent collaborative initiative by seven major automotive manufacturers to form the ‘Ionna’ fast charging alliance highlights a global willingness to overcome the challenges of charging infrastructure. To clarify, with a commitment to build at least 30,000 fast charging points in North America, Ionna aims not only to expand the charging network but also to raise standards of reliability and accessibility by equipping stations with CCS and NACS (North America Charging Standard) connectors.

A worldwide shift towards electromobility

Finally, such initiatives can serve as models for global markets and underscore a worldwide shift towards integrated, user-centric electromobility. In other words, drawing lessons from collaborative efforts like Ionity in Europe and Ionna in North America, other regions can accelerate their own transition to electromobility. In conclusion, adapting these successful models to their specific contexts, the accumulated experience and data shared by these alliances offer a valuable pathway towards optimizing charging networks and promoting global BEV adoption. This marks a crucial step towards cleaner, greener mobility for all.