The rapid growth of Oil & Gas companies in the European EV charging ecosystem

Oil&Gas companies have entered the EV ecosystem quite late, but they demonstrate fast growth.

At Gireve, we are at the heart of the EV charging industry, empowering CPOs and eMSPs with our seamless roaming platform. Combining marketplace technologies, transaction processing, and data management, our mission is to support stakeholders and accelerate their transition to electric mobility on a global scale.

But we don’t stop there; we process and enrich data on charging stations and driver behaviors. We offer insightful analysis and strategic consulting. We believe that this wealth of information will shape the future of mobility, making it sustainable, innovative, and accessible to all.

This is why we’re sharing a series of insights learned from our data, to foster discussions and learn together.

We are happy to present our monthly publication related to our Data and Consulting department: Beyond EV Charging

Executive Summary

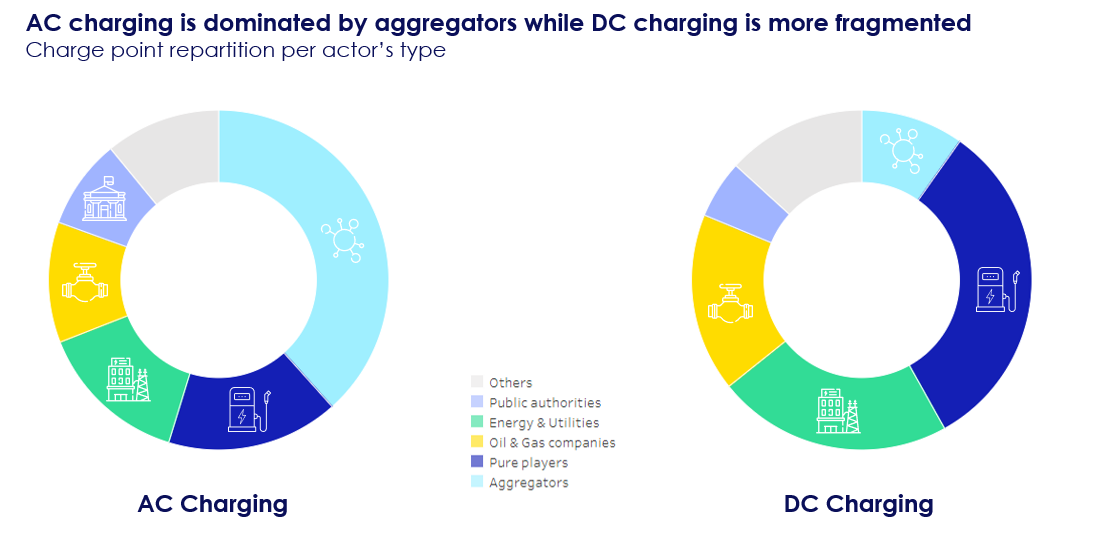

When examining the distribution among various types of players, we note that aggregators dominate the alternative current (AC) segment, while pure players lead the direct charging (DC) one. For AC, this can be attributed to the convenience aggregators offer to various companies in operating charge points. However, DC is more complex and offers more opportunities for new companies to emerge with a higher risk but also with potential higher returns. Despite this, the most significant growth in the past two years comes from Oil & Gas companies. They have been intensifying their investments. While they slowly entered the market several years ago, there has been a noticeable shift, with substantial investments in the EV charging ecosystem. They have, naturally, leveraged acquisitions to initiate, hasten, and broaden their EV charging network.

Introduction: Segmenting CPOs in the EV Charging ecosystem

Electric vehicle charging is an emerging industry that requires the development of an ecosystem. Like any new ecosystem, various entities are entering the field to expand their business and profit from the rapid growth. Some align logically, such as Energy companies, while others seize the opportunity to diversify. We have categorized European actors into six distinct groups to examine their development:

Aggregators

- Companies providing a Charge Point Management System to third parties, operating as an aggregate for these actors.

- Notable players include Last Mile Solutions, Greenflux, and EVBox.

- Aggregators can manage diverse networks, from a single charge point at a small dealership to an extensive network of a gas station company for example.

Pure players

- Start-ups and scale-ups created within the last decade specifically to operate charge points. Electra, Fastned, and Recharge exemplify Pure players.

Oil & Gas companies

- Companies that operate in the oil and/or gas industry such as TotalEnergies, BP and Shell.

Energy & Utilities

- Energy & Utilities combine the companies responsible for generating, transferring and supplying water, natural gas and electricity and also removing sewage from homes in a country.

- EDF, E.ON, and Vattenfall are examples of Energy & Utilities.

Public sector

- Public sector includes all entities that are owned or controlled by the government (we excluded large energy companies fully or partially owned by the government).

- This includes Cities, Counties, Stadtwerke in Germany or Syndicat d’énergie in France.

Others

- Companies that are not included in the previous categories such as airports, parking management, industrials, etc.

This paper examines the market status of EV charging operations. It offers a specific focus on the involvement of Oil & Gas companies due to their recent growth.

EV charging, a market with a diversity of stakeholders

While all types of actors operate in both AC and DC segments, AC charging is primarily led by aggregators. They facilitate charger operation. Many companies leverage their solutions to offer available public chargers to clients such as retail stores. This is why aggregators hold a larger share in AC rather than DC charging. Installing AC chargers is more straightforward and less expensive at their locations. Additionally, small and medium-sized companies often lack the time and resources to operate charge points independently with a white label solution. This is why they opt for the aggregated solution. Aggregators have observed a slight increase in their market share over the past two years.

Pure players are more represented in DC Charging

On the contrary, DC charging is dominated by pure players. They represent approximately a third of the total market share. This aligns with the complexity of operating DC chargers, involving significant capital expenditures. Managing DC chargers is complex, requiring alignment between the rapid growth of the EV fleet and the operating costs increase. They also see a bigger opportunity to make profit in the DC segment and leverage the growth of the ecosystem. Pure players like Fastned or Allego benefit from a decade of experience. They have thus played a pivotal role in expanding the European EV charging market. More recent companies like Electra, Power Dot, or Zunder have thrived in a more developed market with a larger EV fleet, witnessing staggering growth in recent years.

Energy & Utilities in the EV charging ecosystem

As a natural extension of their services, Energy and Utilities companies have also entered the EV charging operation business. Holding a 15% and 22% market share in AC and DC charging, respectively, Energy & Utilities companies contribute significantly to developing EV charging networks. Leveraging their knowledge and advantages as energy providers, they dominate specific markets, like the Nordics (Vattenfal, Mer, Kople, Eviny, Fortum, etc.).

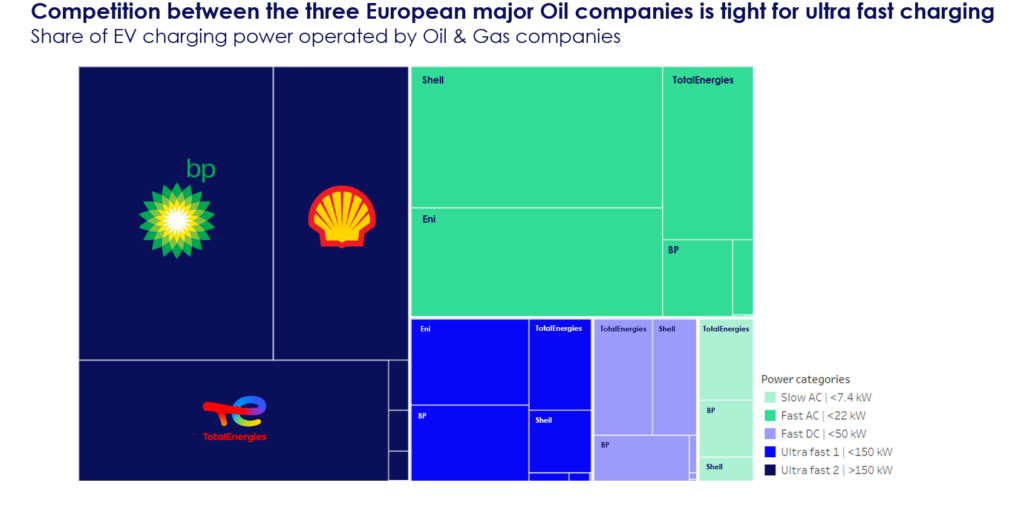

EV charging: the growth of Oil & Gas companies

With the transition from Internal Combustion Engine to Electric Vehicles, Oil & Gas companies adapted by creating subsidiaries to manage EV infrastructures. This category has experienced substantial growth in market share over the past two years, tripling their size in number of charge point (doubling their market share) amid a market that witnessed a twofold increase.

Focus: Oil & Gas companies, the largest growth of the past 2 years!

As previously mentioned, Oil & Gas companies have significantly increased their market share in the EV charging market, adapting to the evolving automotive industry. They were not the initiators of the ecosystem but entered the market by acquiring established pure players. This allowed them to grow rapidly with an extensive and available capital at hand.

This approach allows them to be in a more mature market with a relatively lower risk in their investments. In just two years, they installed nearly 2 GW of charging infrastructure (1 GW = 1,000,000 kW), with nearly two third dedicated to ultra-fast charging.

Oil and Gas companies operate various chargers, ranging from slow to ultra-fast charging. This view weights the charge points with their available power. In terms of number of charge points, Oil and Gas companies operate 83% AC and 17% DC chargers.

Competition is fierce among the three major European oil companies: BP, Shell, and TotalEnergies. Eni comes in fourth with rapid growth in recent years. Shell, however, dominates the AC charging segment with a strong lead, thanks to its acquisition of The Newmotion in 2017, one of the largest networks in Europe at the time. The other two have also relied on acquisitions to expand their networks: G2mobility and Source London for TotalEnergies for example, and Chargemaster for BP.

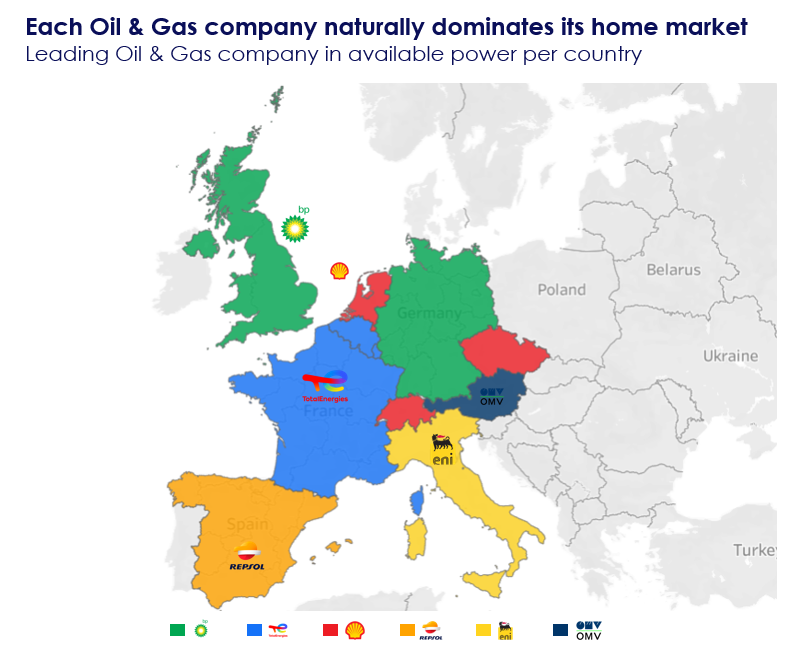

This shift from Oil and Gas companies was initially driven naturally in their home market. Germany stands out as an exception, as its “national oil company” Aral, is owned by BP since 2002. TotalEnergies focused its early expansion on Belgium and Luxembourg as a natural extension of its French network.

Now, the goal is to expand into other markets and compete with other Charge Point Operators (CPOs). For instance, Shell acquired EVPass in Switzerland last year, while TotalEnergies followed a similar approach, acquiring existing chargers from Wenea in Spain earlier this year.

Conclusion

Pure players, Energy & Utilities, Oil & Gas, and aggregators coexist in the European EV charging market. Providing electricity, rather than fuel, is a completely different business, attracting a more diverse range of stakeholders. Each type seems to find its place in the ecosystem.

Aggregators serve as facilitators for deploying AC chargers for any company. Energy & Utilities leverage the opportunity to expand operations, closely linked to their primary activities. Oil & Gas companies transition from providing fuel to supplying electricity. Finally, this new industry let room for innovation and new actors, this is where pure players engaged and profit from the growth of the ecosystem.

Numerous acquisitions by Energy and Oil companies have occurred in recent years, letting us curious about the trend’s continuation. Operating charge points differs significantly from managing fuel stations, offering space for smaller actors and pure players to establish themselves in the industry. This fragmented ecosystem may stay for much longer than expected.