The evolution of ultra-fast charging in France

Discover how ultra-fast charging stations have developed in France over the past few years!

At Gireve, we are at the heart of the EV charging industry, empowering CPOs and eMSPs with our seamless roaming platform. Combining marketplace technologies, transaction processing, and data management, our mission is to support stakeholders and accelerate their transition to electric mobility on a global scale.

But we don’t stop there; we process and enrich data on charging stations and driver behaviors. We offer insightful analysis and strategic consulting. We believe that this wealth of information will shape the future of mobility, making it sustainable, innovative, and accessible to all.

This is why we’re sharing a series of insights learned from our data, to foster discussions and learn together.

We are happy to present our monthly publication related to our Data and Consulting department: Beyond EV Charging

Executive Summary

This paper underscores the rapid evolution of the ultra-fast charging market in France. Initially, Tesla was the sole provider of such services in 2014. In 2018, IONITY joined the scene to establish a network of ultra-fast chargers along the highways. Until 2021, they were the two primary players. Today, the landscape has undergone significant changes, with over 100 CPOs operating ultra-fast chargers, and Tesla maintaining its leadership position. Ultra-fast chargers were extensively deployed in 2022, and this trend continued into 2023. The year 2022 marked a pivotal moment for this sector as retail players entered the game, with Carrefour and Lidl taking the lead. Despite the substantial growth, quality has remained consistent, maintaining a 83% availability rate.

How has ultra-fast charging evolved in France?

When discussing electric vehicles, a significant hurdle to their widespread adoption is autonomy. Consequently, charging emerges as a critical focal point. While the majority of the time (80 to 95%), charging at home proves to be the most convenient method (cost-effective, private property, quick plug-in), longer journeys necessitate charging infrastructure. Ultra-fast charging emerges as the viable solution, enabling EV drivers to cover extensive distances. With a power output ranging from 51 to 600 kW, ultra-fast charging facilitates vehicle charging in under 30 minutes. As explored in a previous paper on 43 kW AC Charging, the charging power will be constrained by the lower capacity of the charging chain, be it the vehicle or the charging station.

This sector has undergone significant evolution in recent months, particularly in France. Therefore, we aim to spotlight key metrics from our database, illustrating the growth of this sector, market dynamics, and the resultant impact on quality.

Ultra-fast lvl 1: 50 kW < Power Output < 150 kW

Ultra-fast lvl 2: Power Output≥150 kW

Evolution of ultra-fast charging

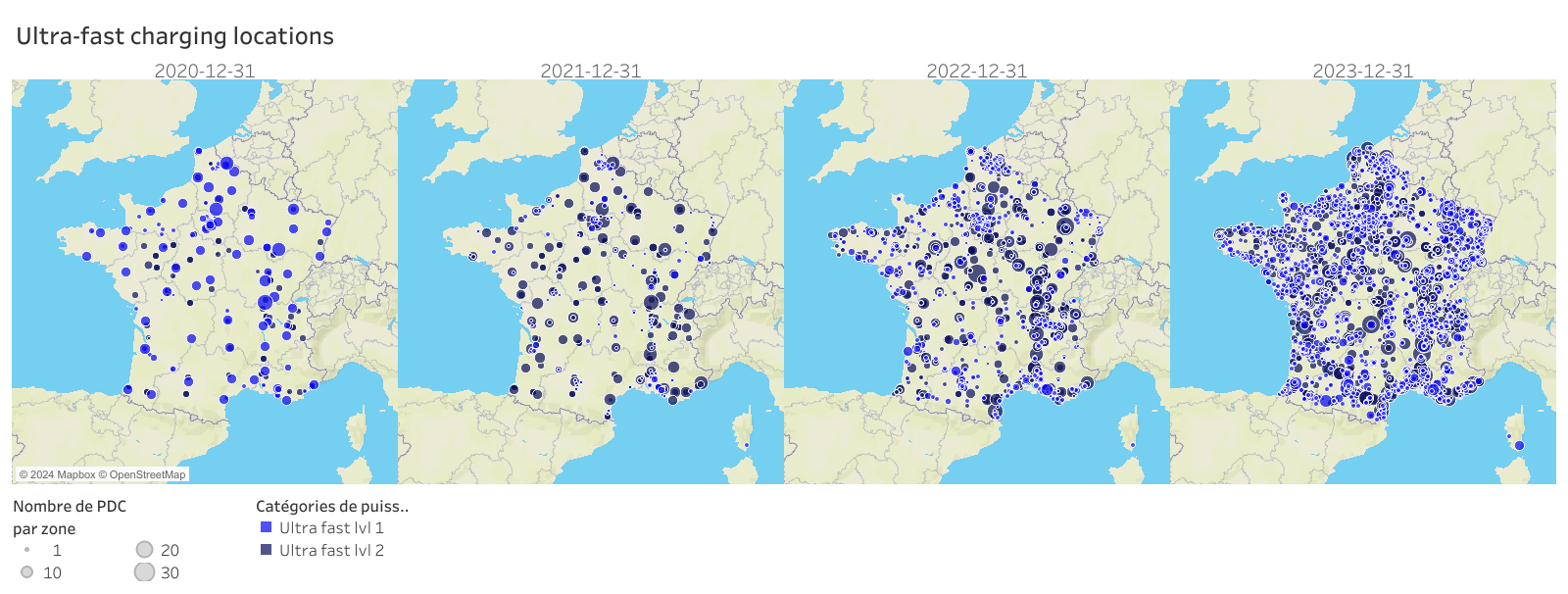

From these detailed maps, we observe a rapid evolution in the number of ultra-fast charging locations across France. Initially, at the end of 2020, only a few charging points existed, primarily along major highways, offering less than 150 kW (ultra-fast lvl 1).

In 2021, there was a modest increase in locations, but now with higher power, exceeding 150 kW (ultra-fast lvl 2).

The year 2022 marked a significant shift, witnessing a clear acceleration in the deployment of ultra-fast charging stations, predominantly along highways. The map vividly outlines the shape of the French highway network.

Moving into 2023, the pace established in 2022 continued, accompanied by a substantial increase in the number of locations. A noteworthy change from 2022 was the diversification of infrastructure locations. Charging stations proliferated beyond highway corridors, with retail groups notably installing them in parking lots. This strategic move not only provides them (retail group) an additional quality service but also ensures compliance with the LOM legislation. Germany experienced a 4-fold increase during the same period but starting with a higher number of chargers.

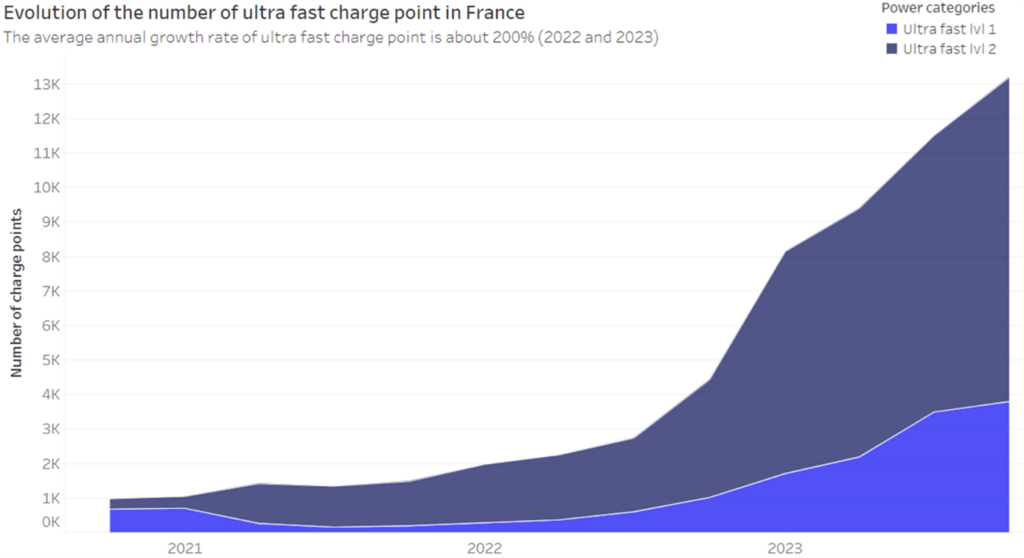

When examining the numbers, we observe a 6-fold increase over only two years. In contrast, Germany experienced a 4-fold increase during the same period but starting with a higher number of chargers.

The reduction in level 1 ultra-fast charging in 2021 is attributed to Tesla upgrading their V2 Supercharger, increasing the power from 125 kW to 150 kW.

As various entities continue to deploy ultra-fast charging stations, level 1 ultra-fast chargers are gaining popularity due to their lower cost for smaller entities.

Evolution of the stakeholders

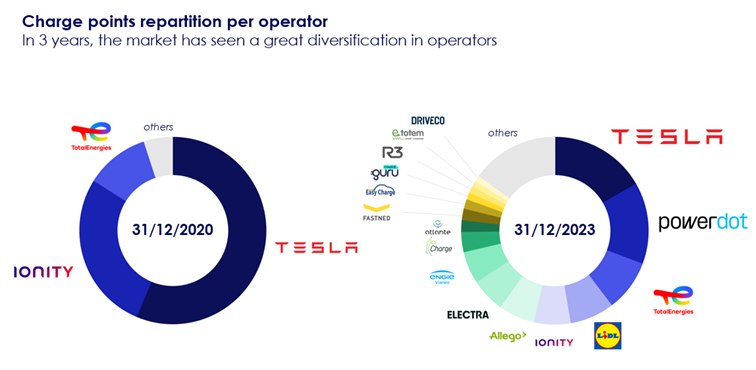

The market has evolved impressively in just three years. At the end of 2020, Tesla and IONITY dominated the ultra-fast charging sector. However, in this short span, numerous new players have entered the market, leading to significant diversification. The number of operators has surged from 14 in 2020 to over a hundred today. Despite this, by the end of 2023, five CPOs control half of the ultra-fast chargers.

The evolution observed in 2023 regarding retail actors installing charging infrastructure is evident in the corresponding graph. Power Dot, Allego, Driveco, Electra, and, notably, Lidl have strategically placed most or all of their charging points on retail parking lots.

How quality has been impacted by this fast evolution?

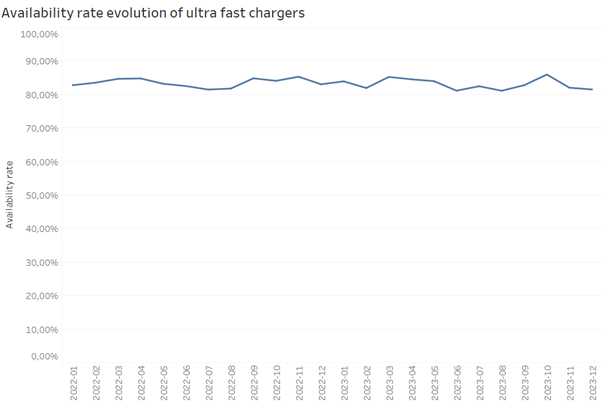

From the graph below, we observe that availability from ultra-fast chargers has remained stable over the past two years. Despite a sixfold increase in charge points, availability hovers around 83%.

An 83% average indicates a relatively low availability rate. Our calculation suggests that a good network should maintain at least an average of 95% availability.

This becomes a crucial indicator to monitor in 2024, assessing whether industry players enhance their reliability post-rapid growth.

Conclusion

To conclude, French ultra-fast charging has experienced rapid growth in the past two to three years. This growth was eagerly awaited by electric vehicle drivers, as highway charging has not been smooth until today. However, companies operating French highways have specific needs, requiring anticipation of future growth to size the charging locations correctly. When installing a charging station on a highway service area, it is sized for the next two years. This is due to groundwork and grid connection which are challenging in these locations. This relates to economic reliability for Charge Point Operators and their need for revenue optimization.

With experience, CPOs will improve the quality of their networks. As more CPOs emerge, competition will play a crucial role in increasing reliability, as EV drivers will (and already) prefer some networks over others, as shown by Chargemap’s 2023 network ranking based on user preference.